In 2024, cobalt demand exceeded 200,000 tonnes for the first time, with battery applications accounting for 76% of total demand and 94% of demand growth.

Global cobalt demand is projected to rise faster than supply over the next decade, shrinking the current market surplus and potentially pushing the sector into deficit by the early 2030s, according to a new report by the Cobalt Institute, an industry association.

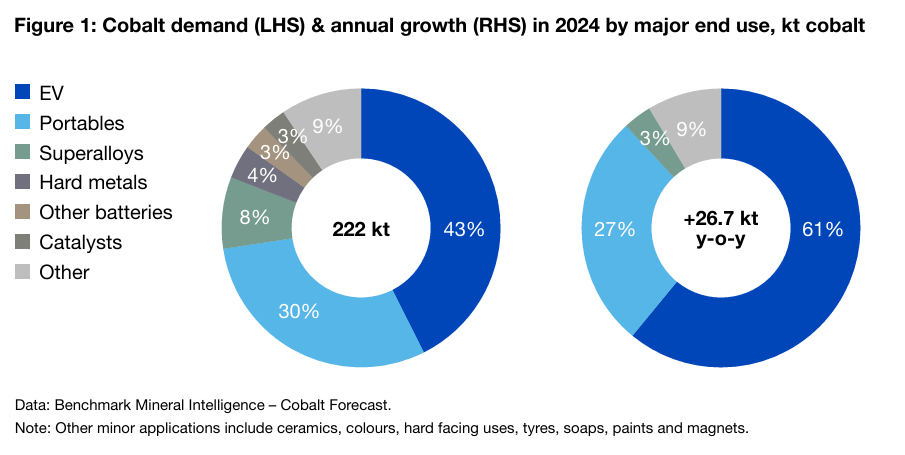

Demand is expected to grow at a compound annual growth rate of 7%, reaching 400,000 tonnes from 222,000 tonnes last year. The surge is expected to be largely driven by the rapid expansion of the electric vehicle (EV) market.

EVs dominate

In 2024, cobalt demand exceeded 200,000 tonnes for the first time, with battery applications accounting for 76% of total demand and 94% of demand growth. EVs alone represented 43% of total consumption, a share expected to grow to 57% by 2030. Other sectors — including mobile phones, laptops, superalloys and industrial applications — are forecast to see more moderate growth.

The portable electronics segment, the second-largest demand source, rebounded last year with 12% year-over-year growth after several sluggish years. Demand from AI applications is also rising, driven by larger battery sizes required for higher computational loads.

On the industrial side, defence spending has lifted demand for cobalt-based superalloys, particularly in military and aerospace sectors.

DRC limits

Supply continues to be dominated by the Democratic Republic of Congo (DRC), which accounted for 76% of mined cobalt output last year. Major producer China Molybdenum Co., or CMOC, reported record-high output of 114,000 tonnes from its Tenke Fungurume and Kisanfu projects — both exceeding guidance by 31%. It surpassed Glencore (LSE: GLEN) as the world’s top producer.

Indonesia, currently holding a 12% market share, is projected to nearly double its share to 22% by 2030, according to the report. Meanwhile, the DRC is expected to maintain a 65%-share by the end of the decade.

Despite growing demand, cobalt prices hit a nine-year low in early 2024, driven by persistent oversupply. Prices over the year fell 15% and 22%, respectively, for cobalt hydroxide (sold to Asia where the seller covers the cost, insurance and freight) and cobalt metal (where the buyer in Europe takes on nearly all responsibility).

To address the glut, the DRC implemented a four-month export ban in early 2024. With the ban set to expire soon, the government has signaled it may impose stricter export controls to stabilize the market. Since the February ban, cobalt prices have rebounded 60%, reaching $16 per pound.