Copper tariffs at two-week low, but China data support

Data released on Monday revealed that China's manufacturing sector expanded at its fastest rate in an entire year in March.

Freeport-McMoRan lowers first-quarter gold sales forecast

Analysts expect the company to post an adjusted profit of 22 cents per share for the first quarter, according to data compiled by LSEG.

First Quantum pulls back from arbitration on Panama copper mine

The government ordered it to shut in December 2023 amid sweeping anti-mining protests and political upheaval.

Vale to receive $1 billion in Alianca Energia JV deal

Vale became sole owner of Alianca last year, when it paid 2.7 billion reais for the 45% stake held by power firm Cemig, with whom it launched the venture in 2013.

Codelco regains title as world’s top copper producer

Chief Executive Officer Ruben Alvarado of Codelco said the company is overhauling everything from geological modelling, to mining technology, to beneficiation processes

China’s foreign mining investment sets record

Regionally, China’s engagement has been strong in various African countries, Bolivia and Chile in Latin America, and Indonesia, the report shows.

Chile’s mining production drops 6.6% in February due to decline in copper processing

The Mining Production Index fell for the third consecutive month, mainly dragged down by metallic copper and reduced lithium activity, according to data from Chile’s National Statistics Institute (INE).

Gold hits new high as Goldman sees $3,300

The new projection, says Goldman analysts Lina Thomas and Daan Struyven, reflects a pick-up in gold purchase by central banks, which have bought over 1,000 tonnes for three straight years and are on track to repeat the same feat in 2025.

TMC has carried out exploratory mining expeditions to the Clarion-Clipperton Zone

Professor Daniel Jones of NOC, said that to tackle the question of recovery from deep-sea mining, it is necessary to first look at available evidence and use old mining tests to help understand long-term impacts.

Gold price soars to all-time high as Goldman Sachs raises forecast to $3,300

Gold hits record levels amid rising trade tensions and safe-haven demand.

Copper price hits record high as market eyes $12,000 milestone amid tariff buzz

With supply constraints tightening and geopolitical developments accelerating policy shifts, copper is firmly in the spotlight—positioning itself as one of 2025’s top-performing commodities.

Challenger Gold secures first US$2M drawdown from US$20M toll milling finance facility

The initial US$2M (~AUD $3.2M) Tranche 1 proceeds will be used for early works associated with preparation for mining to support Toll Milling, general corporate overheads and working capital.

Blue Sky Uranium launches new JV company to advance Ivana uranium-vanadium deposit in Argentina

Blue Sky Uranium Corp. is a pioneer in uranium exploration and development in Argentina.

Trump fast-tracks potential copper tariffs, shaking global markets

The White House could impose a 25% tariff on copper imports in a matter of weeks, triggering price volatility between New York and London and raising concerns across the global mining industry.

Trump invokes wartime powers to boost critical mineral production

Donald Trump signed an executive order on Thursday that uses the Defense Production Act to support investments in the country’s critical minerals and rare earth elements.

Atex stock rises on best copper-gold porphyry assay yet at Valeriano project in Chile

The Valeriano Project is located in the Huasco Province of the Atacama Region of northern Chile.

Russia plans to launch large-scale lithium production in 2030

Demand for lithium has surged in recent years as Russian companies work on the mass production of lithium batteries and electric vehicles.

Southern Copper mining project attacked in Peru, leaving 20 injured

While companies seek to protect their investments and ensure worker safety, the government faces the challenge of finding solutions that balance economic development with social inclusion and sustainability in the mining sector.

Citigroup predicts LME copper price to hit $10,000 before US tariffs

As the situation unfolds, stakeholders across the mining, manufacturing, and investment sectors will need to adapt to an evolving trade landscape that could significantly influence copper pricing trends worldwide.

Bolivia faces strong public backlash over lithium deals with chinese and russian companies

The Bolivian government maintains that these partnerships will fast-track lithium industry development, promising that the country will retain 51% of the generated profits. However, doubts and social resistance continue to challenge the feasibility of these ambitious projects.

Industry conferences flag critical moment for mining’s transformation

With a growing global demand for critical minerals, two of North America’s largest mining conferences have been exploring the strategies and technologies that will drive the sector’s transformation towards sustainability.

PDAC 2025 attracted more than 27,000 participants

PDAC 2025 which brought together 27,353 participants to explore premier business prospects, investment opportunities, and professional networks in the global mineral exploration and mining sphere.

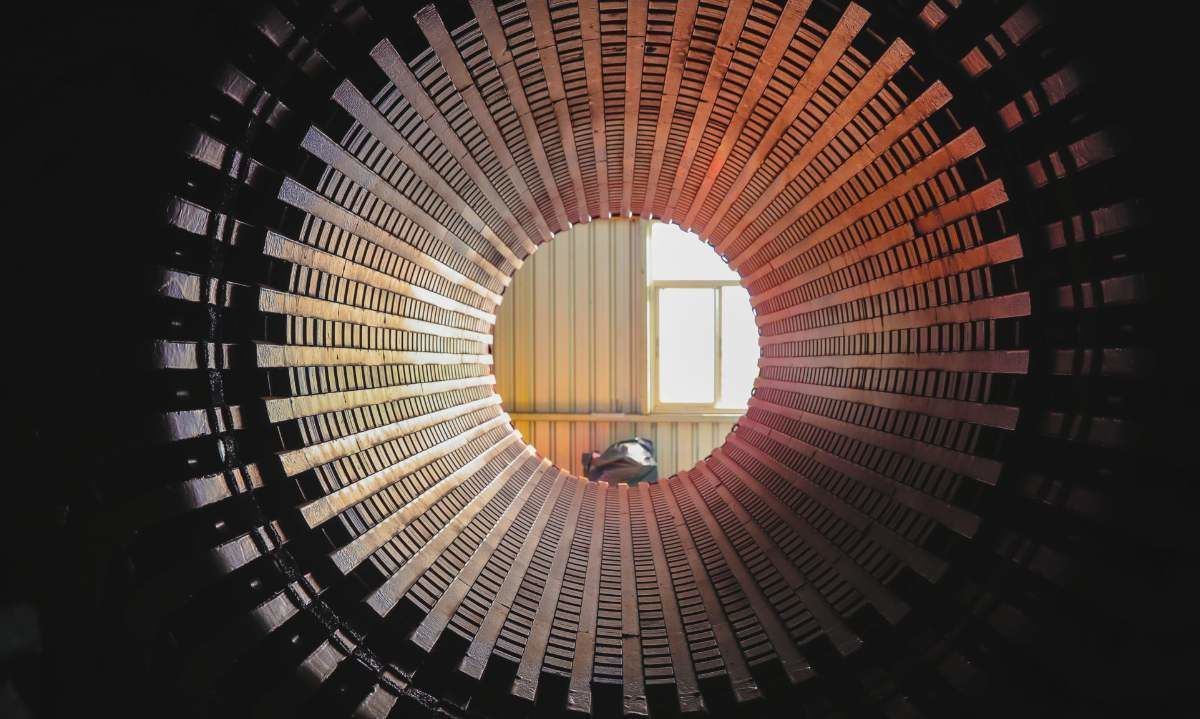

Stator bars in Gearless Mill Drives

In an industry where downtime can result in millions of dollars in losses, ABB’s precision engineering and technological excellence offer an efficient and reliable solution. This allows mining operations to remain competitive, productive, and sustainable.

ABB revolutionizes GMD System Monitoring with MyGMD Widget

The integration of MyGMD Widget with MyABB Portal ensures more efficient and secure management of GMD systems, eliminating the need to search for information across multiple platforms.

ICMM releases updated guidance to strengthen approaches to the closure of tailings storage facilities

The closure of tailings storage facilities is one of the most complex, longest and resource-intensive phases within a mine’s lifecycle.

CAP Announces Strategic Investment in Aclara Resources, Marking its Entry into the Canadian and Brazilian Markets

The company has successfully acquired a 10.18% stake in the Canadian company, which owns the Carina Project in Brazil, the Penco Module in Chile, and a rare earth separation project in the United States.

Codelco and Anglo American sign a historic MOU to promote the development of the Andina-Los Bronces mining district

The companies announced an alliance to implement a Joint Mining Plan that would increase the district's production by nearly 120,000 tons of fine copper per year, between 2030 and 2051.